Over the last several decades, tier-one telcos mostly have grown by acquisition, and also mostly by horizontal acquisitions (more accounts gained in mobile or fixed lines).

The best example is mobile operators moving into new countries. Relatively lesser impact has been seen in organic growth or vertical acquisitions that have telcos moving into other elements of the value chain. At some point, those vertical acquisitions might be determinative.

And that likely is true despite widespread expectation or evidence that horizontal mergers are what is going to change revenue sources (consolidation in Indian mobile market being the best current example); hypothesized activity in the U.S. market being the other potential big development.

Globally, it remains likely that horizontal mergers will have the greatest revenue impact in the near term (both consolidation within markets and growth out of market).

Long term, vertical mergers are more important, if you believe "access" markets are in a "almost no growth" state, and likely to stay that way.

AT&T executives recently pointed out that video, spectrum resources and distribution were three underpinnings of company strategy for the future. Some would say those foundational elements will change again, in the relatively near future, as AT&T eventually assembles a bigger mass of content and app assets.

The best example is mobile operators moving into new countries. Relatively lesser impact has been seen in organic growth or vertical acquisitions that have telcos moving into other elements of the value chain. At some point, those vertical acquisitions might be determinative.

And that likely is true despite widespread expectation or evidence that horizontal mergers are what is going to change revenue sources (consolidation in Indian mobile market being the best current example); hypothesized activity in the U.S. market being the other potential big development.

Globally, it remains likely that horizontal mergers will have the greatest revenue impact in the near term (both consolidation within markets and growth out of market).

Long term, vertical mergers are more important, if you believe "access" markets are in a "almost no growth" state, and likely to stay that way.

AT&T executives recently pointed out that video, spectrum resources and distribution were three underpinnings of company strategy for the future. Some would say those foundational elements will change again, in the relatively near future, as AT&T eventually assembles a bigger mass of content and app assets.

Though business-related assets (internet of things, connected vehicles) likely will play a bigger role at AT&T than entertainment content assets do at Comcast, the principle is the same.

Over time, AT&T will generate growing percentages of revenue from apps and services distinct from its “access” portfolio (mobile and fixed subscriptions). And a larger share likely will come in the “business to business” segment of the business, rather than the “consumer” parts of the business.

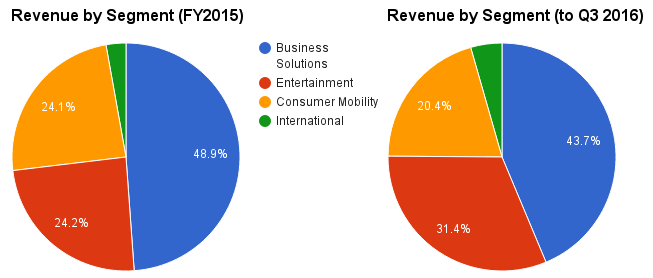

Right now, AT&T revenue is lead by mobility, entertainment and business services, all a mix of “access” revenue (internet access and business data access) and “apps” (voice, messaging, entertainment video subscriptions).

Over time, AT&T will move, as did Comcast, more in the direction of revenues driven by “apps” rather than “access.” Changes in revenue composition have been coming fast at AT&T in recent years, with the single biggest change being AT&T’s leap to status of biggest supplier of linear video entertainment in the U.S. or global markets.

Of course, there are several ways to lump revenue sources. AT&T used to break out “mobility” as a single category. These days it reports business customer revenue (mobile and fixed) as a single category, with consumer mobile as a separate category, and “video and broadband” as a new category, along with international revenues.

In one sense, consumer revenues comprise more than half of total revenues. Mobility probably still drives half of AT&T revenue.

How those sources change over the next decade or two will tell the story of how successful AT&T and other tier-one service providers have gotten in “moving up the stack.”

No comments:

Post a Comment