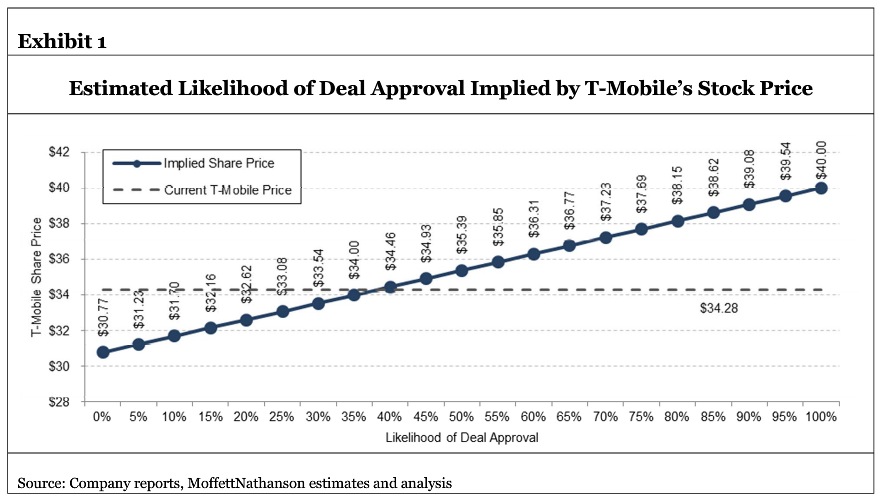

Moffett Nathanson estimates there is only a 10 percent chance that the Justice Department and the Federal Communications Commission will approve any Sprint-T-Mobile merger.

Others disagree, arguing the odds could be as high as 50-50, in part because, as Sprint and

T-Mobile US believe, the other big deals will change the market.

T-Mobile US believe, the other big deals will change the market.

Some might argue the future opportunities both Sprint and T-Mobile US each might have to survive in the U.S. market as independent companies will hinge on the regulatory response.

The argument in favor of a merger is that Sprint and T-Mobile US simply lack the scale and financial resources to catch AT&T Mobility and Verizon Wireless.

The argument against such a deal is that the U.S. mobile market already is too concentrated. But U.S. communications markets are changing, in ways that change market dynamics.

The instability is that Comcast is chasing a deal that would make it the supplier of 40 percent of U.S. fixed network high speed access connections. AT&T wants to vault from five percent share of the U.S. video entertainment market to about 27 percent.

At the same time, Dish Network will enter the market soon as a facilities-based mobile provider, while Comcast will do so as well, probably using a strategy similar to that used by Illiad’s Free Mobile, which rapidly gained significant market share in the French mobile market.

Much of the recent speculation has focused on the potential FCC decision, on the assumption that Sprint has to win over only a single commissioner to put together a three-vote win.

The Department of Justice might be the tougher obstacle, as DoJ normally relies on a market concentration standard that already is above the permissible limit.

The Justice Department will generally investigate any merger of firms in a market where the Herfindahl-Hirschman Index (HHI), a test of market concentration, exceeds 1000 and will very likely challenge any merger if the HHI is greater than 1800.

The U.S. market has an HHI of about 2500. Some would argue that any deal in a market with an HHI over .230 will be heavily scrutinized and most likely rejected.

The issue, some would say, is that most mobile markets eventually consolidate to just three leading players over time, no matter what regulators prefer.

Looking at the biggest 36 mobile markets globally, analyst Chetan Sharma found that the average HHI score of a typical market ranks 3440 on the scale.

Developed markets have an HHI of 3270. The U.S. market HHI is 2500, between “heavily concentrated” and “moderately concentrated” markets. The U.K. market is the notable exception.

Sharma found 30 of the 36 markets over that level.

Whether any of that will weigh on thinking at the Justice Department, or the FCC, is the issue.

Any Sprint deal to buy T-Mobile US will occur in the context of a rapidly-changing market, featuring both consolidation and the emergence of new competitors.

Whether either firm will survive long term, if a merger is rejected, is the issue.

Some might also argue that one’s perception of the odds--at least at the FCC--likely hinges on how one views the politics of three bit mergers being proposed at the same time.

Sprint thinks its chances are better because two other big deals are proposed. Moffett Nathanson thinks odds, conversely, are worse.

"Approving all three would be untenable for the left,” Moffett Nathanson says. “Rejecting all three would be untenable for the right.”

“At least one of the three would have to be rejected,” Moffett Nathanson concludes. Sprint is the likely loser.

No comments:

Post a Comment